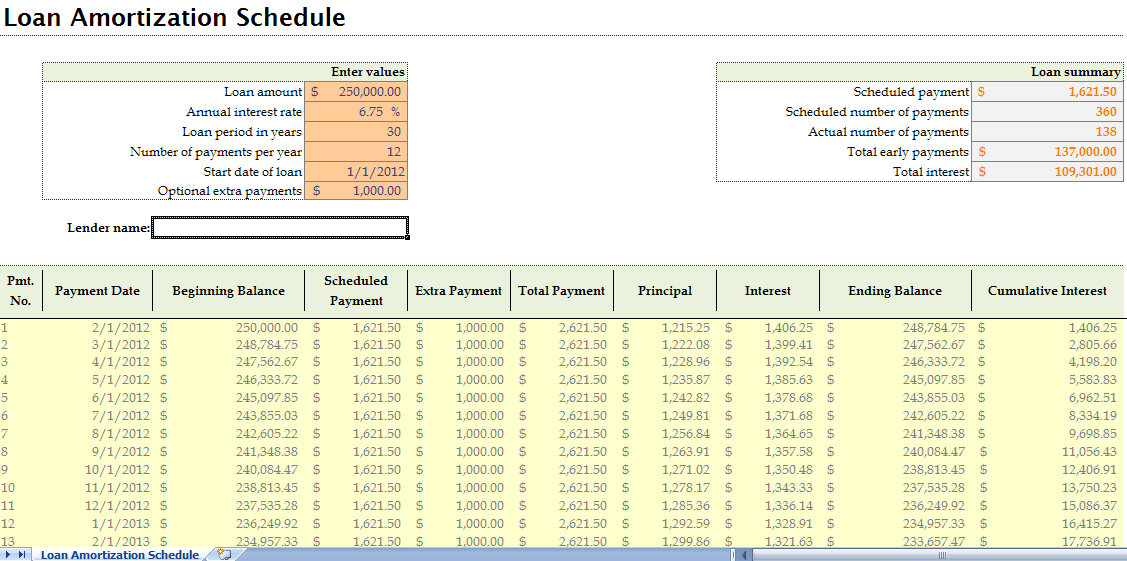

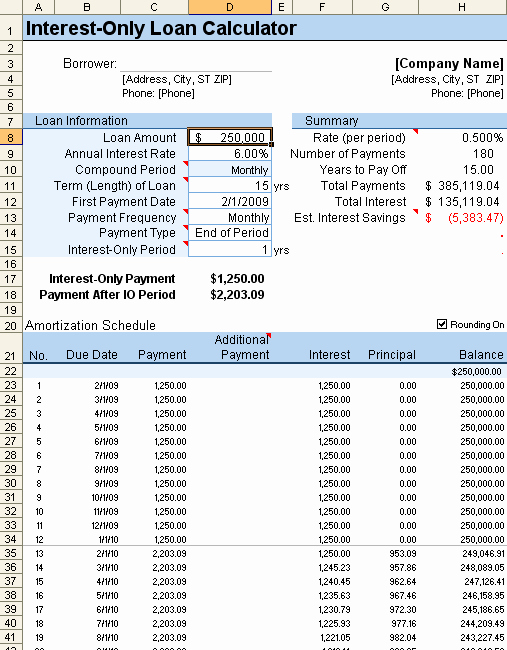

You might not even think about trying to pay off your mortgage early. When you sign on for a 30-year mortgage, you know you're in it for the long haul. Irregular Extra Payments: If you want to make irregular extra contributions or contributions which have a different periodicity than your regular payments try our advanced additional mortgage payments calculator which allows you to make multiple concurrent extra payments with varying frequencies along with other lump sum extra payments.įor your convenience current Los Angeles mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.If you do not have a statement to see the current balance you can calculate the current balance so long as you know when the loan began, how much the loan was for & your rate of interest. For example, if you are 3.5 years into a 30-year home loan, you would set the loan term to 26.5 years and you would set the loan balance to whatever amount is shown on your statement. Extra Payments In The Middle of The Loan Term: If you start making extra payments in the middle of your loan then enter the current loan balance when you started making extra payments and set the loan term for however long you have left in the loan.Biweekly Payment Method: Please see our bi-weekly mortgage calculator if you are using biweekly payments to make an effective 13th monthly payment.Want to Make Irregular Payments? Do You Need More Advanced Calculation Options? We also offer three other options you can consider for other additional payment scenarios. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. In addition, you will get the loan paid off 2 Years 1 Months sooner than if you paid only your regular monthly payment. If you make the initial extra payment amount you entered and pay just $50.00 more each month, you will pay only $380,277.66 toward your home. By the time the 30 year time period is complete, you will have paid $391,682.75 for your home. If you take out a 30 year loan for $250000.00 with a 3.250% interest rate, for example, your monthly payment (interest and principal only) will be $1,088.02.

When it comes to a home mortgage loan, you can actually pay off the loan much more quickly and save a great deal of money by simply paying a little extra each month. This calculator will provide good results but you may want to also talk to your loan provider to get a calculation from them.Your Results in Plain English ( Switch to Financial Analysis) (payment = principal + interest) Monthly Extra the extra amount you plan to add to your monthly payments on this mortgage. This value is not always easy to find but usually you can look at your last statement to find the amounts applied to principal and interest and add these 2 numbers together. DO NOT include insurance or taxes or escrow payments these are not applied to your loan. Current Monthly Mortgage Payment the amount currently to be paid on this mortgage on a monthly basis toward principal and interest only. Note that this is the interest rate you are being charged which is different and normally lower than the Annual Percentage Rate (APR).

To also run scenarios for new payments by changing the loan term tryĬurrent Mortgage Balance the outstanding principal when calculating a current mortgage or the original amount on a new loan Interest Rate the annual nominal interest rate or stated rate on the loan. (negative extra payments to pay less) Create an amortization schedule. Use this calculator to calculate repayment of your mortgage and add extra payments to find how much it reduces the length of your loan term and the amount of interest you can save over the life of the mortgage.

0 kommentar(er)

0 kommentar(er)